What is Balance Sheet ? & How to Read it ?

In this article we will discuss significance of balance sheet and how to analyse it .

What is Balance Sheet ?

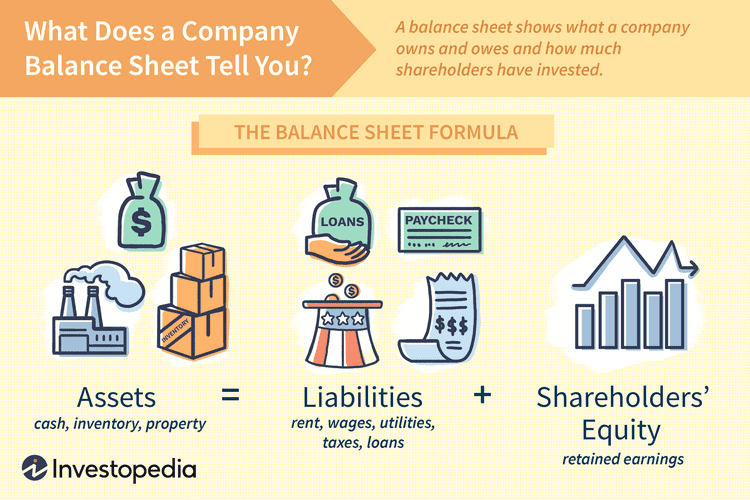

- A balance sheet is a financial statement that reports a company’s assets, liabilities, and shareholder equity.

- The balance sheet is one of the three core financial statements that are used to evaluate a business.

- It provides a snapshot of a company’s finances (what it owns and owes) as of the date of publication.

- The balance sheet adheres to an equation that equates assets with the sum of liabilities and shareholder equity.

- Fundamental analysts use balance sheets to calculate financial ratios.

The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out:

Assets=Liabilities+Shareholders’ Equity

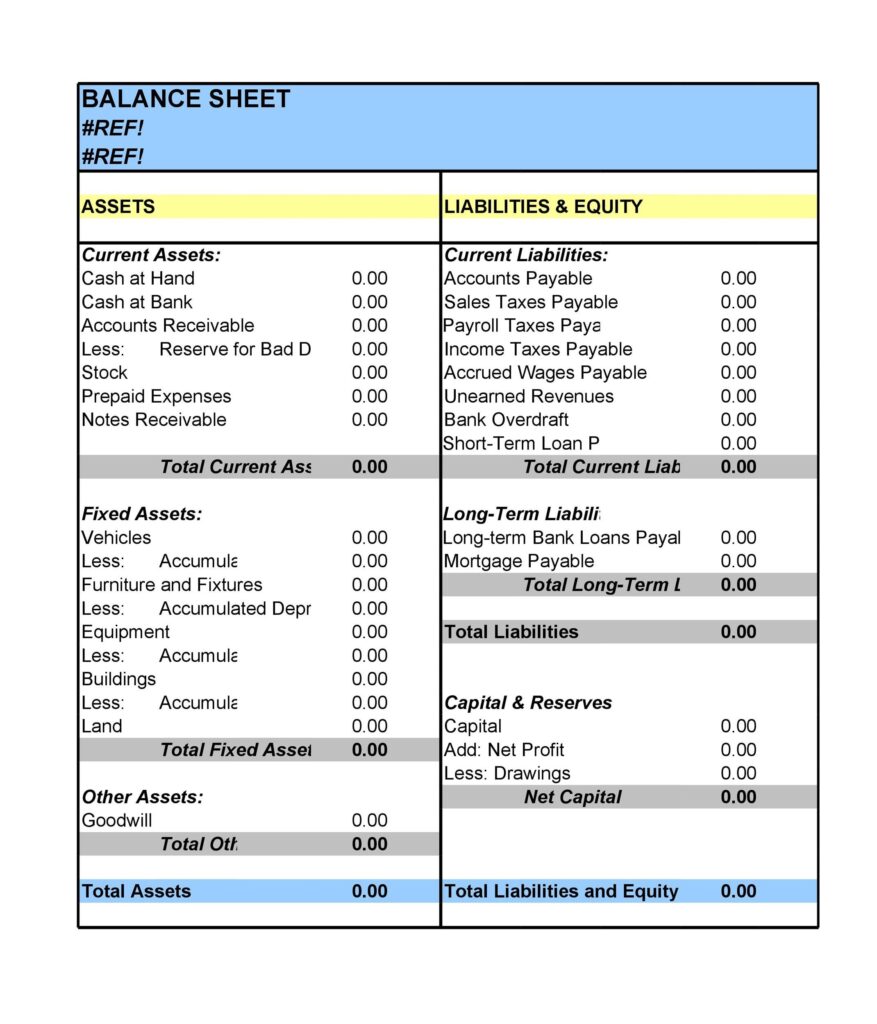

Here is a example of Balance Sheet ..

Current Assets

Cash and Equivalents

The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash Equivalents are also lumped under this line item and include assets that have short-term maturities under three months or assets that the company can liquidate on short notice, such as Marketable securities. Companies will generally disclose what equivalents it includes in the footnotes to the balance sheet.

Accounts Receivables

This account includes the balance of all sales revenue still on credit, net of any allowances for doubtful accounts (which generates a bad debt expense). As companies recover accounts receivables, this account decreases, and cash increases by the same amount.

Inventory

Inventory includes amounts for raw materials, work-in-progress goods, and finished goods. The company uses this account when it reports sales of goods, generally under cost of goods sold in the income statement .

Non-Current Assets/ Fixed Assets

Plant, Property, and Equipment (PP&E)

Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets. The line item is noted net of accumulated depreciation. Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. All PP&E is depreciable except for Land.

Intangible Assets

This line item includes all of the company’s intangible fixed assets, which may or may not be identifiable. Identifiable intangible assets include patents, licenses, and secret formulas. Unidentifiable intangible assets include brand and goodwill.

Depreciation

Reduction in the value of an asset as a result of the wear and tear due to its use or with passing of time .

Other assets include deferred tax assets and deferred tax liability ,deferred expenditure ,pre-paid expenses or ” Loans and advances”

Current Liabilities

Accounts Payable

Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

Current Debt/Notes Payable

Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year.

Current Portion of Long-Term Debt

This account may or may not be lumped together with the above account, Current Debt. While they may seem similar, the current portion of long-term debt is specifically the portion due within this year of a piece of debt that has a maturity of more than one year. For example, if a company takes on a bank loan to be paid off in 5-years, this account will include the portion of that loan due in the next year.

Accrued Liabilities

They represent expenses or obligations incurred in an accounting period ,payment for which will be made in the next period .

Provisions

When a business anticipates a liability in future but unable to determine it’s exact amount it estimates the amount of the liability and shows it in the balance sheet .

Contingent Liability

Liabilities that are likely to become a liability only in the happening of certain events .

Non-Current Liabilities

Bonds Payable

This account includes the amortized amount of any bonds the company has issued.

Long-Term Debt

This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). This account is derived from the debt schedule, which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period.

Shareholders’ Equity

Share Capital

This is the value of funds that shareholders have invested in the company. When a company is first formed, shareholders will typically put in cash. For example, an investor starts a company and seeds it with $10M. Cash (an asset) rises by $10M, and Share Capital (an equity account) rises by $10M, balancing out the balance sheet.

Retained Earnings

This is the total amount of net income the company decides to keep. Every period, a company may pay out dividends from its net income. Any amount remaining (or exceeding) is added to (deducted from) retained earnings.

Working Capital

it is the capital employed by the farm in conducting its day to day business .

Working Capital = Current assets -Current liabilities

What to see in the balance sheet ?

1. Components of capital employed : The relative proportion of debt funds versus equity funds are an important item to be looked into (often, known as capital structure issues). If a company increasing its long term liabilities considerably without increasing its shareholders funds, then it can indicate that the company taking more risks and that it is increasingly run by external funds which make its operations more prone to bankruptcy. Moreover, increase in debt implies higher interest costs for the company. which can lead to unprofitable operations.

2. Consistent increase in trade receivables (debtors) amount and their relative proportions in the balance sheet is also not a good sign. It can possibly indicate that the company might have a few major customers who are not paying or are dictating terms to the company. It can even indicate the firm’s changing credit policy or customer group. It might signal that the company is making its credit policy more lenient in order to sustain in a competitive market by allowing debtors more time to pay back the money they owe to the firm. It might, however, be harmful for a company as it may block a company’s funds with the debtors. Similarly, a piling up inventory, i.e., consistent increase in the amount of inventory when compared to last year is a cause of concern and needs to be probed further.

3.If fixed assets are decreasing considerably for any business, it indicates that the company is possibly downsizing. Often, this is a result of cash crunch and thus selling its non-current assets to meet its day to day requirements of funds.

4. If accounts payable of any company increases considerably over a period of time, it indicates that the company is perhaps able to negotiate better with the suppliers with regard to repayment of its dues. In a company w ith other bad siens. this can indeed inability to fulfill its short-term commitments, hence inviting a more serious problem.

5. Importance is also to be given to notes to accounts, i.e., other supplemental information-specially focusing on the ones that are providing explanation or qualification of items in the balance sheet. For example, contingencies and contingent liabilities such as corporate guarantees, bank guarantees and disputes of additional income taxes of prior years.

6. Also, look at the details of essential supporting schedules on aspect such as valuation methods used, especially for asset items such as inventories, investments in subsidiaries, other non-current assets and their depreciation methods.

7. Explanations of certain contractual obligations or ensuring restrictions attached either to specific assets or, more likely, to liabilities. Covenants on debt taken are a good example of the same.

8. Disclosures of certain events that have occurred after the balance sheet date but before the financial statements have been issued, lie., post-balance sheet disclosures also need to be assessed.

Thank you for reading it . You can follow me at SURAJIT BHOWMIK

You can share this article with your friends on

Read our other article

- Crorepati Calculator

- Management Quality Scoring Tool

- How to Check Management Quality of A Company

- Market Temperature Check

- Relative Valuation Calculator : Determine Fair Value of a Stock

if you want our upcoming blogs get directly delivered to your mail then subscribe here

For more details follow us on every social media (links given at the bottom of website ). Thank You .