How to Read and Analyse A Profit & Loss Statement !

In this article we have discussed what is profit and loss statement and how to read it

A profit and loss (P&L) statement, also known as an income statement, is a financial report that provides information on a company’s revenues, expenses, gains, and losses over a specific period of time, usually a fiscal quarter or year.

The purpose of a P&L statement is to show a company’s financial performance and profitability during that period. It typically includes revenue from sales, interest income, and other sources, as well as expenses such as cost of goods sold, operating expenses, and taxes. The difference between the revenue and the expenses is the company’s net income or loss for that period.

A P&L statement is an essential tool for business owners, investors, and creditors to understand a company’s financial performance and to make informed decisions about its future. It can help identify areas of the business that may be underperforming, and provide insight into whether the company is generating sufficient profits to cover its expenses and invest in growth.

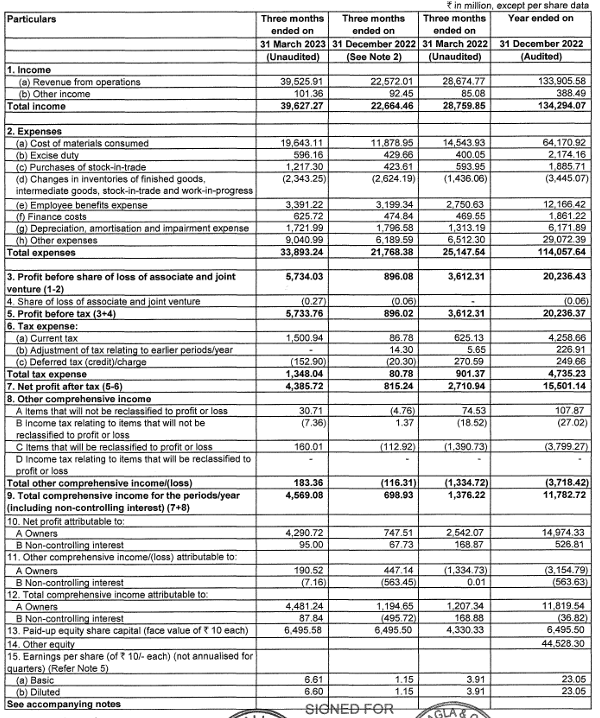

Let us look at a sample and then define each term categorically

This is how a typical P&L statement looks like .

Revenue / Income

Revenue also called the “top line” of the P&L, is the money that you’re bringing in from your sales of goods and /or services .

If you’re a non-profit, this would be money raised from fundraising. Usually, a company will have a separate table that details their sales and then bring the total sales number over to the P&L.

Of course, revenue is a pretty critical number as it’s what you need to cover your expenses. The lower your revenue number, the lower your expenses need to be in order to stay profitable.

Other Income

Other income in a profit and loss (P&L) statement refers to any revenue or income that a company generates from sources other than its primary operations. It includes any gains that are not related to the company’s normal business activities.

Examples of other income may include:

- Interest income from investments or loans

- Dividends received from investments

- Rental income from leasing out property or equipment

- Insurance settlements or reimbursements

- One-time gains from the sale of assets, such as real estate or investments

Direct costs

Direct costs, also known as cost of goods sold (COGS), are the costs that you incur when you make your products or deliver your services. You don’t include things like rent or payroll here, but you would include the things that directly contribute to each sale.

For example, for a bike shop, the direct cost of every sale is what the shop paid to buy the bikes from the manufacturer. For a bike manufacturer, direct costs would include the cost of the metal and plastic used to make the bike.

However, if you’re a consultant, it’s possible that you have very low or even no direct costs. You might have costs associated with printing reports and photocopying, but not many other costs.

Gross margin

Gross margin tells you how much money you have leftover to cover your expenses after you’ve covered the cost of the product or service you are selling. Simply subtract your direct costs from your revenue and that provides you with gross margin.

Revenue – Direct Costs = Gross Margin

For example, if you buy a widget for $1 and sell it for $3, your gross margin would be $2.

The gross margin percentage represents that number as a percentage—the higher the number, the better. You calculate that percentage by dividing your gross margin by revenue:

Gross Margin / Revenue = Gross Margin %

When you have a high gross margin, that means that it costs you very little to deliver your product or service and you’ll have the majority of the money from every sale left over to cover your expenses.

Operating expenses

Operating expenses cover all of the expenses that you incur to keep your doors open, excluding your direct costs that we talked about earlier.

Expenses – Direct Costs = Operating Expenses

This usually includes your rent, salaries and benefits, marketing expenses, research and development expenses, utilities, and so on. Don’t include the interest you pay on loans or taxes here, though.

Operating income

Operating income is also known as EBITDA (earnings before interest, taxes, depreciation, and amortization). This is calculated by subtracting total operating expenses from your gross margin.

Gross Margin – Total Operating Expenses = Operating Income

Interest

Here’s where you’ll include interest payments that your company is making on any outstanding loans.

Depreciation and Amortization

These are special expenses associated with assets that your company owns. Over time, assets (like vehicles and large pieces of equipment) lose their value or depreciate. You’ll expense that decline in value here.

Taxes

Any taxes that you pay or expect to pay on your sales show up here.

- Current tax is the amount of income taxes payable (recoverable) in respect of the taxable profit (tax loss) for a period.

- Deferred tax liabilities are the amounts of income taxes payable in future periods in respect of taxable temporary differences.

- Deferred tax assets are the amounts of income taxes recoverable in future periods in respect of: (a) deductible temporary differences; (b) the carry forward of unused tax losses; and (c) the carry forward of unused tax credits.

Net profit

Also known as net income or net earnings, it’s the “bottom line” that you hear so much about. You started with your revenue as your “top line” and then subtracted things as you went: direct costs, operating expenses, and so on. What’s leftover is your profit, or potentially your loss if you ended up spending more than you earned.

That’s your profit and loss statement explained. But, don’t forget: Profits are not the same as cash. Just because you made a profit doesn’t mean that money is actually in the bank. You’ll want to dive into your cash flow statement to better understand the difference and how to maintain a healthy cash position.

What to Look for In a Profit and Loss statement before Investing

When considering investing in a company, the profit and loss (P&L) statement is a key financial document to review. Here are some specific items to look for:

- Revenue growth: Look for consistent revenue growth over time. If a company’s revenue is declining, it may indicate that the company is struggling to maintain its market share or is facing competitive pressures.

- Gross profit margin: The gross profit margin indicates how much profit a company makes after deducting the cost of goods sold. A higher gross profit margin is generally preferable, as it indicates that the company is able to generate more profit from each unit of product or service sold.

- Operating expenses: Review the company’s operating expenses to understand how efficiently it is managing its costs. If operating expenses are consistently increasing, it may indicate that the company is struggling to control its expenses or is investing heavily in growth.

- Net income: The net income indicates how much profit a company has left after all expenses are deducted. A consistently positive net income is generally preferable, as it indicates that the company is profitable and able to generate returns for its shareholders.

- Other income and expenses: Review any other income or expenses listed in the P&L statement to understand how they may be affecting the company’s profitability. For example, if a company is consistently generating significant income from non-operating activities, it may be less reliant on its core business for revenue.

Overall, it’s important to review the P&L statement in the context of the company’s overall financial position, industry trends, and future growth potential before making an investment decision.

Thank You for reading , Follow me at Suratjit Bhowmik (Founder ,kinginvestment.in, NISM Certified Equity Research Analyst , Investing since 2017)

If you found the article helpful please share it on

Follow us on every social media ,Links given at bottom of the website .

Read our other articles here

- Crorepati Calculator

- Management Quality Scoring Tool

- How to Check Management Quality of A Company

- Market Temperature Check

- Relative Valuation Calculator : Determine Fair Value of a Stock

To get all the Blogs directly get delivered to your mail , subscribe here