How to Read and Analyse A Cashflow Statement ?

Cash is referred to as the trump card for any business entity. Cash is just like the oil in the machine of a business, & a Cash Flow Statement is the just like the cash summary of the machine, wherein all the cash inflows & outflows in a business over a period of time are stated

What is Cashflow Statement ?

A cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a specific period of time. It shows how changes in balance sheet accounts and income affect cash and cash equivalents.

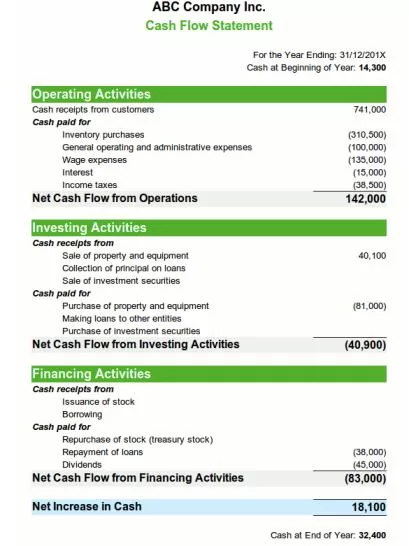

The cash flow statement is divided into three main sections:

- Operating Activities: This section shows the cash generated or used in the core operations of the business. It includes cash receipts from sales, cash payments to suppliers and employees, and other operating expenses.

- Investing Activities: This section reports the cash flows from buying or selling long-term assets or investments. It includes cash inflows from the sale of property, plant, and equipment, as well as cash outflows for purchasing such assets or making investments.

- Financing Activities: This section includes cash flows related to the company’s financing activities. It shows the cash received from issuing debt or equity, as well as cash payments for dividends, debt repayments, or stock repurchases.

What to Analyse on a Cash Flow Statement !

A Cash Flow Statement helps to answer the following type of

questions:

- How did cash position change, compared to the accounting profits

reported based on the income statements? - Did the firm issue/redeem any share capital during the period?

- How was the expansion in the plant and machinery financed?

- How much money was borrowed during the year?

- From where did the company bring in and spend out the cash?

- What is the company using extra cash for?

- Has the company’s operating activities generated enough cash to support the payment of interest, dividends and fund its CAPEX (Capital Expenditure) during the period?

a) If NO, then how have the payments for interest, dividends and

CAPEX been dealt with?

b) If YES, then how was the excess cash dealt with?

Operating Cash Flow/Net Sales

This ratio, which is expressed as a percentage of a company’s net operating cash flow to its net sales or revenue (from the income statement), tells us how many dollars of cash are generated for every dollar of sales.

There is no exact percentage to look for, but the higher the percentage, the better. It should also be noted that industry and company ratios will vary widely. Investors should track this indicator’s performance historically to detect significant variances from the company’s average cash flow/sales relationship along with how the company’s ratio compares to its peers.

It is also essential to monitor how cash flow increases as sales increase since it’s important that they move at a similar rate over time

Free Cash Flow

Free Cashflow is often defined as the net operating cash flow minus capital expenditures. Free cash flow is an important measurement since it shows how efficient a company is at generating cash. Investors use free cash flow to measure whether a company might have enough cash, after funding operations and capital expenditures, to pay investors through dividends and share buyback.

To calculate FCF from the cash flow statement, find the item cash flow from operations—also referred to as “operating cash” or “net cash from operating activities”—and subtract capital expenditures required for current operations from it.

You can go one step further by expanding what’s included in the free cash flow number. For example, in addition to capital expenditures, you could include dividends for the amount to be subtracted from net operating cash flow to arrive at a more comprehensive free cash flow figure. This figure could then be compared to sales.

- Negative cash flow may indicate something other than financial trouble. For instance, investing cash flow might be negative because a company is spending money on assets that improve operations and the products it sells.

- If a company’s cash flow is continually positive, it’s a strong indication that the company is in a good position to avoid excessive borrowing, expand its business, pay dividends, and weather hard times.

Free cash flow is an important evaluative indicator for investors. It captures all the positive qualities of internally produced cash from a company’s operations and monitors the use of cash for capital expenditures.

Thank you fro reading it , Please share it with other on

follow me Surajit Bhowmik

Read our other post

- Crorepati Calculator

- Management Quality Scoring Tool

- How to Check Management Quality of A Company

- Market Temperature Check

- Relative Valuation Calculator : Determine Fair Value of a Stock

To get our latest blogs on your mail , subscribe here

Follow our all social media handle . Link given at bottom of our website .