50 STOCKS TO STUDY FOR “AMRITKAAL BHARAT”

HELLO folks, hope you all are doing all well , currently nifty is around all time high ,loksabha election just finished , what to do now ?

We got Coalition Govt this time with Shree Narendra Modi ji as PM , also budget passed this year . So what to do now ? what should be our plan of future ?

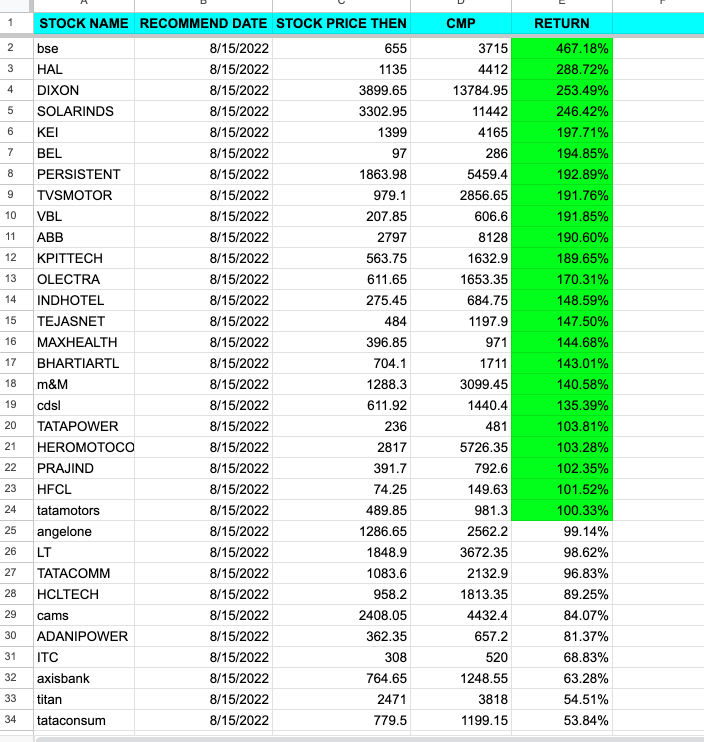

Before I discuss about the new stock ideas let us look at the performance of the stocks i wrote on August ,2022 . I wrote a article here 75-stock-for-75-year-young-india , and discussed about 75 stocks for future growth potential , surprisingly most have given good return with average of 70 % till date and some are extraordinary as below

Here is the complete list

As time changes many things changes like geopolitics , govt , policy etc .So does the performance of many companies , only few companies tend to survive for decades otherwise many languish . So investing does not mean you invest and forget , you need to read , track ,and take decisive action on your invested stocks to stay safe .

If you know nothing about stock or does not have time to read and track or both then you should invest via Mutual fund , If you don’t know where to start or which fund will be suitable for you please feel free to contact Mr Suman Bhowmik ( Member of “Association of Mutual fund of india ” , NISM certified ) for guidance .

Let’s come to today’s topic , at first we see macro economic condition of India ,

India is now world’s most populous country with largest young workforce with a large demographic dividend, India’s GDP is estimated to be growing at a strong rate, with some projections indicating that the country could be the third largest economy in the world by 2030 .

2023-24 GDP estimates: The real GDP is estimated to be ₹173.82 lakh crore, with a growth rate of 8.2%. The nominal GDP is estimated to be ₹295.36 lakh crore, with a growth rate of 9.6%.

2024-25 GDP projections: The real GDP is projected to grow between 6.5–7%.

S&P Global Marketplace projections: The report predicts that India’s economy will double in size by 2030–31, and its global GDP share will increase from 3.5% to 4.5%.

India remains an attractive destination for FDI, thanks to its large market size ,low debt to GDP ratio , a stable political environment, and a focus on manufacturing. Key sectors like technology, pharmaceuticals, and renewable energy have attracted significant foreign investment.

Amrit Kaal Bharat: Vision for 2047

Amrit Kaal” refers to the golden period leading up to 2047, the centenary of India’s independence. This vision outlines India’s aspirations to become a fully developed and self-reliant nation with inclusive growth and modern infrastructure.

The plan for Amrit Kaal is based on key objectives outlined by the Indian government:

Inclusive Economic Growth:

- MSMEs: Support through schemes like PLI and credit access to boost Micro, Small, and Medium Enterprises.

- Agriculture: Focus on doubling farmers’ incomes, digital agriculture, and modernizing supply chains for rural development.

Digital Transformation and Innovation:

- Digital India: Aim to be a global leader in AI, blockchain, data science, and fintech.

- Digital Infrastructure: Enhance connectivity in rural areas and promote e-governance for citizen empowerment.

Manufacturing and Self-Reliance (Aatmanirbhar Bharat):

- Build domestic capabilities and reduce import dependence in key sectors like defense, electronics, pharmaceuticals, and renewable energy.

Infrastructure Development:

- Gati Shakti Plan: Improve logistics and develop multi-modal transportation to boost manufacturing.

- Smart Cities: Develop urban infrastructure with green energy and efficient transportation.

Climate Change and Sustainability:

- Renewable Energy: Target 500 GW of renewable energy capacity by 2030.

- Net Zero by 2070: Commit to long-term carbon footprint reduction.

Human Capital Development:

- Healthcare: Strengthen public health with initiatives like Ayushman Bharat.

- Education: Modernize education through NEP 2020 and focus on skills for future jobs.

Social Equity:

- Gender Equality: Empower women with schemes for entrepreneurship and education.

- Poverty Alleviation: Job creation, direct benefits, and affordable housing to reduce poverty.

Global Leadership:

- Strengthen India’s global role in organizations like the UN, G20, and BRICS, and foster strategic partnerships with key economies.

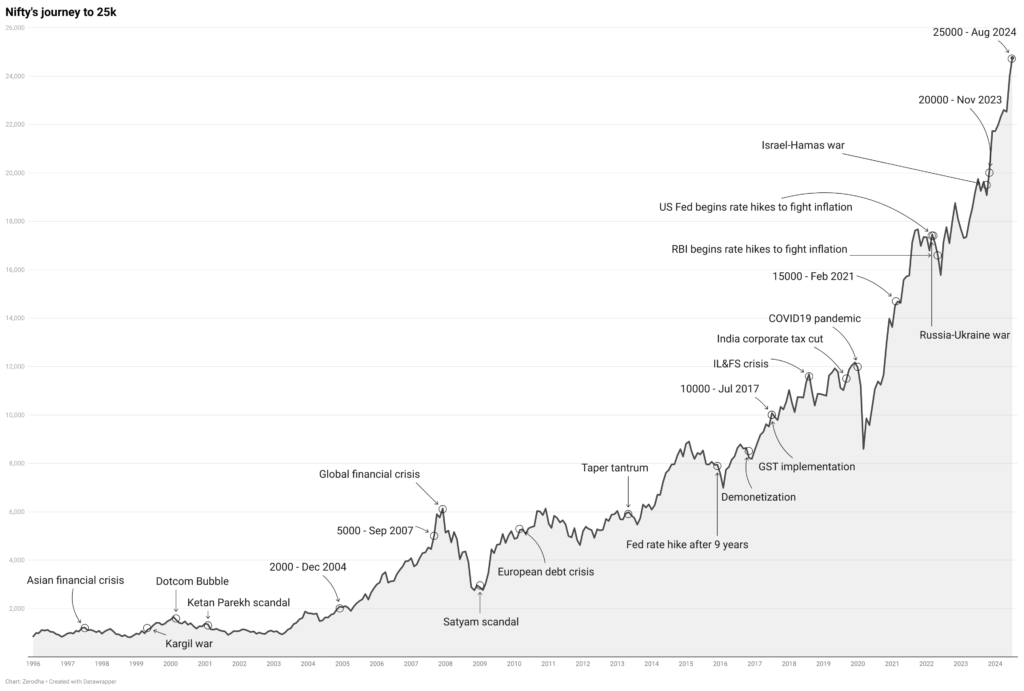

As a hardcore Optimist i am very bullish for india for atleast next 25 year , we have many lacunas ,so there is scope for lot to improve , create and innovate .As the economy grow so will the stock market , in between there will be crash , correction which i can’t predict , but in the long term market will rise .

Here i will be discussing key themes (and related companies) of emerging opportunity to look for investing from current scenario .

Disclaimer : These are for your study only , you should research deeply before investing ,and keep tracking or consult your financial advisor for advice . We are not responsible for any loss . Assuming readers as conservative investor i will be avoiding small , micro cap stocks .

Let’s Dive in

1. MANUFACTURING

India has been focusing on becoming a global manufacturing hub through initiatives like “PLI”, “Make in India”, launched in 2014, which aims to attract both domestic and foreign investment and boost the manufacturing sector’s contribution to GDP.

- DIXON TECH

- KAYNES TECH

- GENUS POWER

- PG ELECTROPLAST

- JYOTI CNC

- HFCL

- APAR INDUSTRY

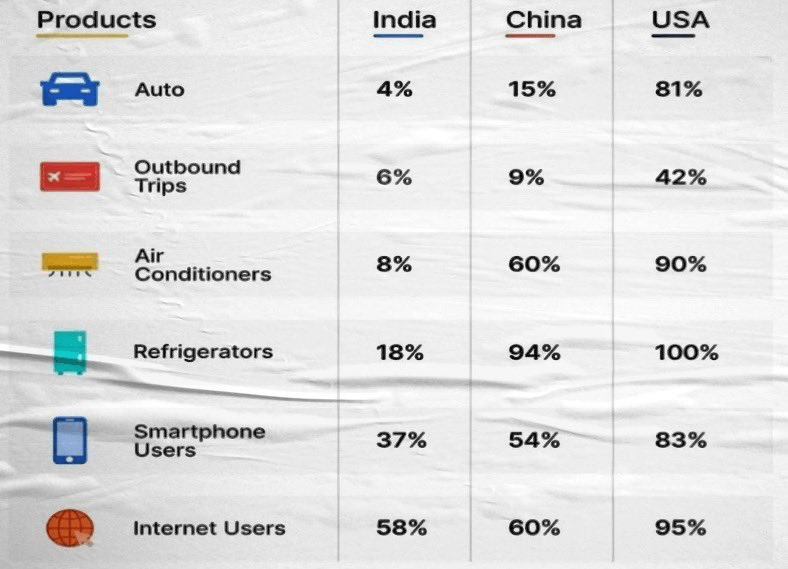

2. FINANCIALISATION

Currently india’s population is 140 crore plus , but only 4.5 crore i.e 8 % of total population invest in mutual fund ,we have only 10 crore demat accounts , only 8 crore people have credit card , insurance penetration is only 3.25 % of GDP . These are very low compared to developed countries . So we have miles to go

- CAMS

- CDSL

- BSE

- NUVAMA WEALTH

- LIC

- MOTILAL OSWAL

- ANGEL ONE

3. CONSUMPTION

With rising per capita income, rising aspirations of young Indians , I believe India will see mother of consumption rally

- TATA MOTOR

- VOLTAS

- TITAN

- ZOMATO

4. GREEN ENERGY

India’s green energy ambition is focused on achieving 500 GW of renewable energy capacity by 2030, with a strong emphasis on solar, wind, and green hydrogen. The country aims for net-zero carbon emissions by 2070. India is also pushing for electric mobility, green hydrogen production, and significant investments in renewable infrastructure to reduce its reliance on fossil fuels.

- NTPC

- ADANI GREEN

- TATA POWER

- INOX WIND

- IREDA

- WAAREE RENEWABLE

5. RECYCLING

India’s recycling sector is rapidly growing, driven by increasing awareness of waste management and sustainability. The sector primarily focuses on recycling plastics, metals, e-waste, and water treatment.

- GRAVITA

- VA TECH WABAG

- WELSPUN ENTERPRISE

- GANESHA ECOSPHERE

6. DEFENCE

India’s defense sector is experiencing rapid modernization, with a focus on self-reliance through the “Make in India” initiative, promoting indigenous production of weapons and equipment. The government is increasing defense budgets, fostering defense startups, and encouraging private sector participation. Looking ahead, India aims to become a global defense exporter, enhance its military capabilities with cutting-edge technologies like AI and drones, and strengthen its strategic defense partnerships.

- HAL

- BEL

- MAZAGON DOCK

- ZEN TECHNOLOGY

- BEML

7. RAILWAY

India’s railway sector is undergoing significant modernization and expansion, focusing on enhancing infrastructure, safety, and efficiency through initiatives like the National Rail Plan and Dedicated Freight Corridors. The introduction of high-speed trains, smart coaches, and digital technologies aims to improve passenger experience and freight movement.

- SIEMANS

- ABB

- CG POWER

- BHEL

- RVNL

- NCC

- HBL POWER

- RAILTEL

- GE T&D INDIA

8. INFRASTRUCTURE

India’s infrastructure sector is witnessing robust growth, driven by government initiatives like the National Infrastructure Pipeline (NIP), which aims to invest over $1.4 trillion in various projects, including roads, railways, and urban development. The focus on sustainable and resilient infrastructure is reflected in efforts to improve connectivity and boost economic growth.

- L&T

- NBCC

- ACTION CONSTRUCTION

9. TOURISM

India’s tourism sector is rebounding post-COVID-19, with initiatives like Incredible India and Atithi Devo Bhava aimed at promoting domestic and international tourism. The government is focusing on improving infrastructure, such as airports and roads, and enhancing safety measures to attract travelers.

- INDIAN HOTEL

- INDIGO

10. ARTIFICIAL INTELLIGENCE

India’s artificial intelligence sector is rapidly evolving, fueled by significant investments from both the government and private players, with a focus on applications in healthcare, finance, and agriculture. The demand for data centers is surging due to the increasing need for cloud services and data storage, driven by AI and digital transformation initiatives. Looking forward, India aims to become a global AI hub by enhancing its research capabilities and workforce skills .

- NETWEB

- TATA ELXSI

- ANANT RAJ

Another theme which is emerging is semiconductor manufacturing and assembling under Bharat Semiconductor Mission , but this is now in nascent stage . But companies like Kaynes , LnT , CG power are foraying into it which we already mentioned .

Thanks for reading ; You can follow me at SURAJIT BHOWMIK

Do you want to know what is in my portfolio ? You Can follow here

Share This article with others via

Read Our Other Blogs

- Crorepati Calculator

- Management Quality Scoring Tool

- How to Check Management Quality of A Company

- Market Temperature Check

- Relative Valuation Calculator : Determine Fair Value of a Stock

If you want our upcoming blogs get directly delivered to your mail then subscribe here

For more details follow us on every social media (links given at the bottom of website ). Thank You .

Posts

- My Portfolio (August 1, 2022)

- Which sector will lead Next Bull Run ? (August 1, 2022)

- My 5 Year Journey in Stock Market (August 6, 2022)

- Why Maximum People Lose Money in Stock Market ? (August 8, 2022)

- Big Bull Rakesh Jhunjhunwala Passed Away (August 14, 2022)

- 75 Stock For 75 Year Young India (August 15, 2022)

- What are the Best Websites for Fundamental and Technical Analysis of stocks? (September 10, 2022)

- Why STOCK MARKET ? (September 30, 2022)

- Checklist for Stock Picking !! (November 7, 2022)

- 20 GOLDEN INVESTING RULES BY PETER LYNCH (November 28, 2022)

- 📚 10 INVESTMENT Books You Should Read.. (December 25, 2022)

- What is Hedge and How to Do it ? (January 13, 2023)

- How to Find Red Flag while Analysing Companies ! (March 7, 2023)

- SIP Calculator (March 21, 2023)

- Investor Form (March 22, 2023)

- What are the Common Mistakes Investor Makes ? (March 22, 2023)

- Some Unfortunate Truths About Investing (March 26, 2023)

- Some Important Principles of Investing (March 26, 2023)

- Site Map (April 6, 2023)

- What is Balance Sheet ? & How to Read it ? (April 12, 2023)

- How to Find Top And Bottom of Stock Market ? (April 25, 2023)

- My Live Stock Portfolio (April 25, 2023)

- How to Read and Analyse A Profit & Loss Statement ! (May 2, 2023)

- Company Financial Performance Check (May 9, 2023)

- How to Read and Analyse A Cashflow Statement ? (June 21, 2023)

- When to Sell a Stock ? (June 30, 2023)

- Get 650 Rupees for Free with TCS buyback | 100 % Genuine (November 16, 2023)

- Get 3000 Rupees for Free with Bajaj Auto Buyback | 99.9 % Genuine (January 8, 2024)

- Fundamental Analysis By The King Investment (March 21, 2024)

- “Must-Know Trading Terminology for Every Trader” (June 21, 2024)

- “A Complete Guide to Financial Ratios and Investment Terms” (June 21, 2024)

- 50 STOCKS TO STUDY FOR “AMRITKAAL BHARAT” (September 30, 2024)

- Future Value & SIP Calculator (November 22, 2024)

- SWP Calculator (December 1, 2024)

- 2024 Year-End Letter to Our Premium Members (December 31, 2024)

- “Stop Doing This Mistake in 2025 If You Want to Get and Stay Rich” (January 7, 2025)

- The Twelve Step Health Test (January 10, 2025)

- Calculate Your Sleep Score (January 17, 2025)

- EAT THAT FROG ! Book Summary (February 5, 2025)

- The Satvik Revolution Book Summary (February 5, 2025)

- Summary of How To Make Money in Stocks (February 20, 2025)

- Claim Your Free T Shirt from The King Investment (February 20, 2025)

- Techno Funda Analysis Of Indian Stock Market (February 22, 2025)

- All Important Tools And Calculator (February 28, 2025)

- Summary of Jesse Livermore’s How to Trade in Stocks (March 2, 2025)

- CAGR And Advanced Compounding Calculator (March 7, 2025)

- King Investment Services – Investor Guidelines (March 7, 2025)

- Summary of Trade Like a Stock Market Wizard by Mark Minervini (March 29, 2025)

- Decoding the Secrets of the Turtles: A Summary of “The Complete TurtleTrader” (April 2, 2025)

- Calculate Intrinsic Value of a Stock (April 16, 2025)

- Relative Valuation Calculator : Determine Fair Value of a Stock (April 16, 2025)

- Market Temperature Check (April 28, 2025)

- How to Check Management Quality of A Company (May 14, 2025)

- Management Quality Scoring Tool (May 14, 2025)

- Crorepati Calculator (July 9, 2025)